FINTECH

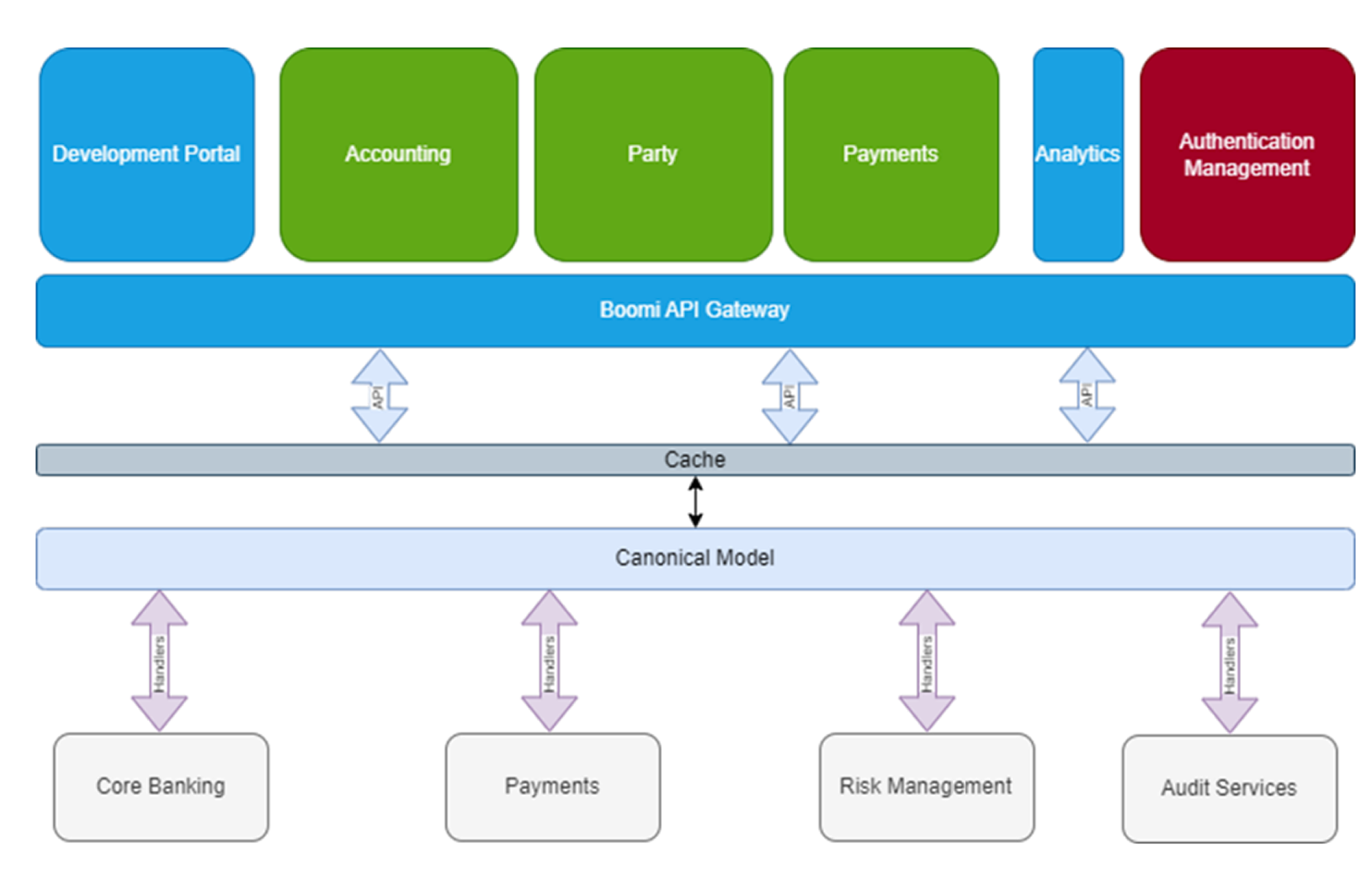

Our accelerator solution for the FinTech industry. We provide a pre-built custom connector to seamlessly integrate credit union applications with their Core banking. This product includes pre-built integration and mappings in an easy-to-use framework.

Easily integrate solutions such as Jack Henry, DNA, Encompass, Genysis, Five9, Dynamics 365, MeridianLink, and more.